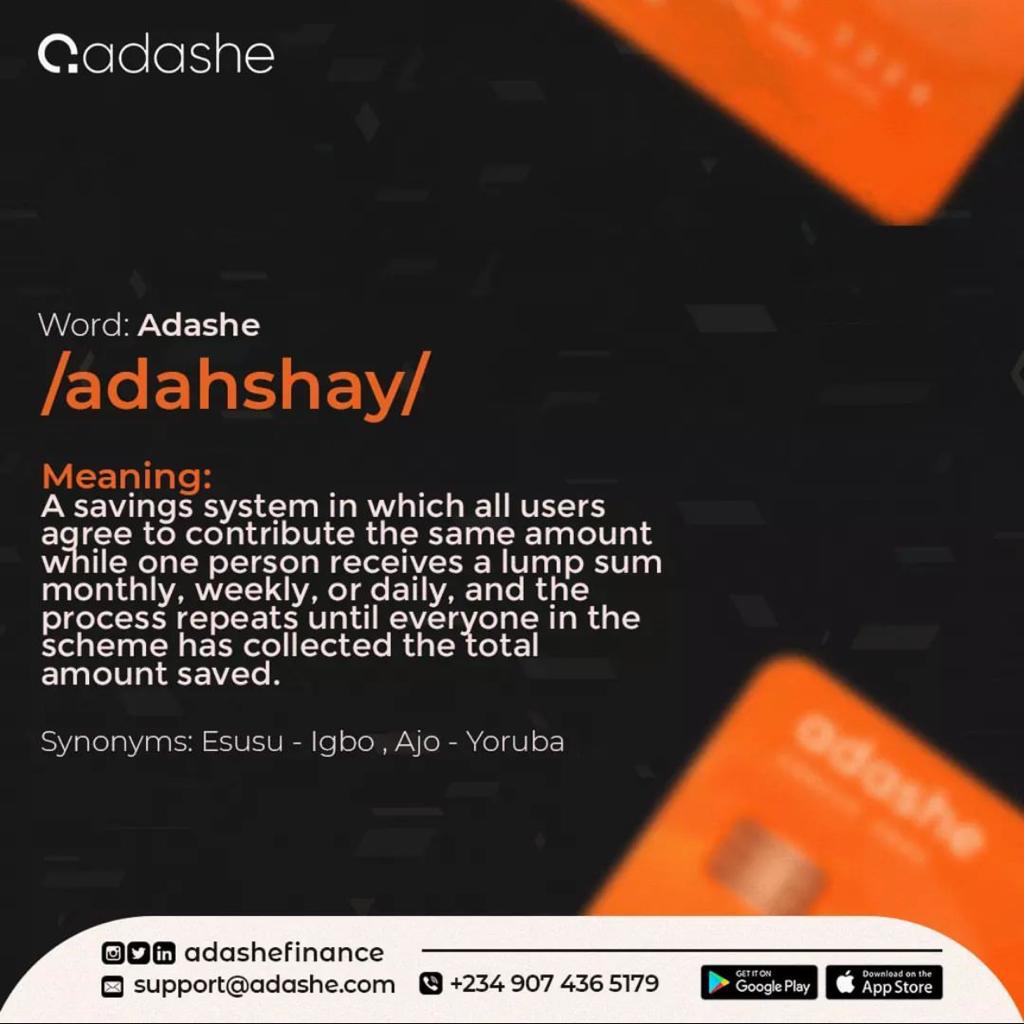

Communal living has always been a part of the ‘African way’, by raising bulk money to cater for their needs, long before the advent of loans, seed fundings, overdrafts, and mortgages. You are most likely aware of this system, perhaps you know it as ‘Isusu’, ‘Ajo’, or ‘Akawo/Adashe’.

It is simply people coming together in agreement to fund each other’s needs or businesses by micro units of daily, weekly, or monthly contributions. The group agrees to each donate an agreed sum of money and then take turns in collecting the bulk donation until every member has been serviced. This age-long practice has formed the backbone of several businesses spread across Africa. This ingenuity and doggedness of spirit have sustained the continent birthing several generations of innovators and pacesetters.

According to a recent study by Statista, African entrepreneurs are breaking barriers with innovative approaches to solving problems unique to the continent. The study showed that the number of startups in Nigeria was estimated to have exceeded 3, 360 in 2022 alone, the highest number ever recorded in the continent closely followed by Kenya and South Africa counting approximately 1, 000 and over 660 startups in the same year respectively.

This rapid proliferation of startups has been driven by increased access to technology, a growing middle class, and a youth demographic that is eager to innovate and create new businesses. However, one of the significant challenges facing startups in Africa is securing funding.

This is due to a lack of developed capital markets and a shortage of venture capital firms on the continent. Many investors are also wary of investing in African startups due to concerns about political stability, corruption, and lack of infrastructure. To overcome these challenges, startups in Africa often have to look beyond traditional funding sources and explore alternative options such as ‘crowdfunding’, ‘impact investing’, and ‘corporate partnerships’.

This is where Adashe Finance comes in, as a leader in this charge with exemplary tech products and services. The fintech brand has brilliantly reinvented the age-long practice of Isusu/Ajo/Adashe by providing a much-needed platform for Africans to raise interest-free capital to support their businesses.

Adashe Finance made room for financial literacy, inclusion and liberation by developing a product that guarantees access to both local and international investments with as little as $1. The brain-child of Gis Jerry and Godswill Idoko, Adashe Finance was birthed after the founders noticed a dearth between ideation and fruition amongst African entrepreneurs. According to them;

We noticed that entrepreneurs and small business owners now rely on high-interest loans to fund their businesses and this got us thinking about the traditional Adashe/Ajo practice with which Africans raised capital and conveniently funded their businesses as a community. This motivated us to build a software that can rejuvenate and bring back this practice amongst Africans, both old and young and we set to work since then. We also added features that ensure every African has access to local and international investments with as little as $1.

The Adashe brand is committed to improving the financial practices of Africans starting in Nigeria. They have successfully curated three distinct product offerings for savings, investment and foreign and local currency payments. Their primary product is the savings platform for Africans in need of huge capital for business and personal needs.

They are able to create a savings community where every member contributes a fixed amount of money towards raising a huge capital/loan to be received by a member on a weekly/monthly basis. This way, every member of the community receives an interest-free loan and pays it back in instalments towards another member’s capital.

The savings community works like the typical Ajo/Esusu that Africans are used to, They’ve also created a payment solution via virtual cards that helps users in Africa and the diaspora to conveniently save and make a stress-free payment in currencies of choice, anywhere in the world.

Additionally, the investment scheme provides Africans living in Africa and the diaspora with little capital for investors who are willing to pursue financial freedom and the opportunity and platform to invest in real estate and the local and foreign stock market with as low as $1. Thus, the brand commits to giving Africans at any income level a chance at building a better financial future without committing to high-interest loans.

With all of this and more, Adashe Finance is on it’s way to solidifying its place as an industry leader, committed to helping business owners, entrepreneurs, salary earners, and students, who have keen interests in savings, investments, capital raising, and the local/foreign stock markets.

The brand hopes in the near future to build a vast community of young African entrepreneurs who are unafraid to pursue their dreams and are no longer held back by a lack of financial independence.

To stay up to date with their brand and their products and services, find them across all social media platforms:

Visit their website

Please note; The information provided here does not translate to investment, financial, or trading advice and should not be treated as such.

Kindly do your due diligence.

Sponsored Content

The post Interest-Free Capital & Virtual dollar Card, are Exciting Features from Adashe Finance | Here’s all you need to know appeared first on BellaNaija - Showcasing Africa to the world. Read today!.

from BellaNaija https://ift.tt/O2N9zFa

via IFTTT